2016-02-08 | 9222 ![]() Print

Print ![]() PDF

PDF

So, how do forex traders decide when to buy or sell? There are basically two schools of traders, and you must decide which school fits your trading personality. The first school is the school of fundamental analysis. Fundamental traders use economic reports and news reports as the basis for their trading decisions. Forex traders who have a fundamental approach will closely examine world events, interest-rate decisions, and political news. Fundamental traders are concerned with properly interpreting news, whereas the focus for the technical forex trader is quite different. The technical forex trader uses technical indicators (or “indicators”) to properly interpret price movement on a chart. The forex trader who adopts a technical, indicator-based approach will examine the price charts. So, while the fundamental forex trader is concerned with interpreting news and world events, the technical trader is concerned with interpreting price on a chart.

Best Forex Indicators encourage “secondary thinking,” which is a real handicap for traders looking to acquire expertise. Secondary thinking involves analyzing the Forex indicator, spending time considering where the Forex indicator may go, rather than focusing on the market. Naked traders, by definition, focus on the market, which is very different.

Focusing on best Forex indicator may be one of the primary reasons that some forex traders do not make money. Forex Indicators can be confusing, unhelpful, and just plain wrong. We take a look at technical trading, and some of the tragic trading mistakes forex traders make, and how to avoid them by adopting the naked-trading approach.

In some ways, trading with indicators makes it difficult to find profits. Perhaps a close look at why indicator-based trading systems have difficulty finding profits in forex is in order. All indicators are created from price data. This is what all Forex indicators do to price data: Price data enters into an equation and is spit out as something else. Sometimes the end product is a squiggly line, sometimes a straight line, sometimes a color or a number; it depends on the indicator. The end result is always the same: The Forex indicator changes price data via a formula. The form of this end result (the indicator) may vary, but the process is always the same. These very same indicators, based on price data, are meant to hint at future movements in the market. Stated another way, an indicator will suck in price data, massage and process these data, and then spit out a graphical representation of these data. Indicators offer price data in another form. Perhaps this new form of price data is easier to interpret; perhaps this new form of the price data will hint at what the market may do in the near future. All indicator-based trading systems are founded on the idea that price data is in a better form when presented as an indicator. Trade decisions based on indicators assume that the data in indicator form is more valuable than raw price data.

Indicators may be incorrect. What if the Forex indicator is correct, but a bit slow to hint at the direction the market will take?

The indicator might provide valuable information, but might also be slow to the party, and thus not of much value.

Perhaps a slight change to the indicator formula will speed it up a bit.

Perhaps indicators are similar to a wristwatch, best constantly improving, more features available as needed, but would it be possible to take a wristwatch, and manipulate time by running a formula through the hours, the minutes, and the seconds displayed on the wristwatch? Would the wristwatch keep better time once the formula manipulated the actual time of the day? Using a formula to create the best time on a wristwatch may seem weird and counterproductive, but this is precisely what indicators may accomplish by changing and massaging price data. Indicator-based trading is taking a wristwatch and changing the time with a complex formula in the hopes that the wristwatch will somehow tell time better. Who wants a wristwatch with something other than the real time displayed? Do Forex indicator (all of which are calculated using price data) allow us to understand price best?

Forex Indicators are inherently slow. The market will be moving up long before an indicator suggests it is time to buy. Likewise, an indicator will suggest it is time to sell long after the market has started falling. This is one of the main complaints with indicators: they lag behind price.

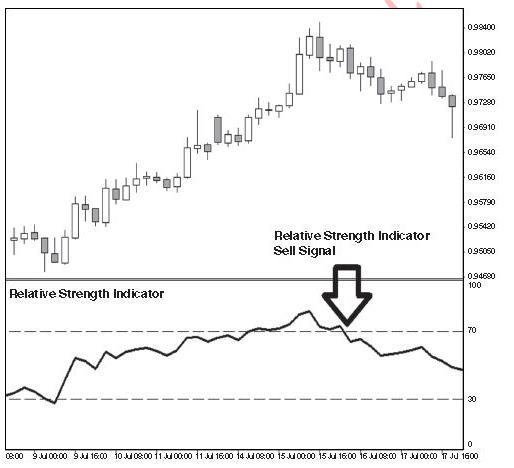

This is a fair concern. Figure 1.0 contains an AUD/USD four-hour chart with the Relative Strength Index (RSI) indicator. Traditionally, there are two RSI signals. If the RSI is above the 70 level, the market is overbought, and once the RSI

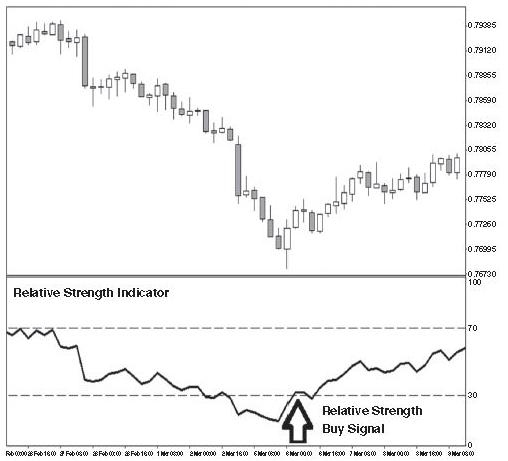

falls back down below 70, a sell trade is initiated. Likewise, if the RSI falls below 30, the market is said to be oversold,

and, traditionally, a buy trade is signaled once the RSI moves back above 30.

FIGURE 1.0 Traditional RSI Sell Signal on AUD/USD 4-Hour Chart.

FIGURE 2.0 Traditional RSI Buy Signal on AUD/USD 4-Hour Chart.

The EUR/USD 1-hour chart below shows the stochastic falling below 30 on the stochastic. A few hours later, the stochastic crosses upward and rises above 30, a clear buy signal. The stochastic is moving up, so price should follow. However, the market then falls a further 90 pips. For most traders this trade would be a big loser. What about the naked trader? In this instance, the naked trader gets a very clear buy signal after the stochastic buy signal (see Figure 3.0). What happens after the naked trading signal? The market jumps more than 40 pips immediately. In naked trading the naked trader avoids many losing trades by

waiting for a price action signal and quickly finds profits. Note in naked trading not all naked trades are winners, of course, but this trade is an example of how the naked trader is able to avoid some of the very common indicator-based mistakes because the naked trader uses the price action of the market to determine entry signals.

FIGURE 3.0 EUR/USD 1-Hour Chart—Traditional Buy Signal on the Oversold Stochastic.

FIGURE 4.0 EUR/USD 1-Hour Chart—Naked Buy Signal versus Stochastic Buy Signal.

The traditional stochastic buy signal occurs immediately before the market falls.

The naked trader has a buy signal at the market turning point.

Notice how the naked trader avoids the drawdown with this trade signal. The market immediately moves in the expected direction, upward, after the signal. Contrast this entry to the stochastic entry signal. The characteristic indicator lag associated with the stochastic means that the stochastic trader not only enters a losing trade, but immediately after the stochastic signal the market trades in the wrong direction, and the trade enters into a protracted drawdown. In fact, it is unlikely that the stochastic trader ever had profit on this trade. Naked-trading strategies enable the trader to enter a trade based on current market price action, and often avoid the severe drawdowns associated with indicator-based trading.

Most traders believe severe drawdowns are a part of trading. This is simply not true. Severe drawdowns are characteristic of mistimed entry signals, and most traders use indicators to find entry signals, so most traders mistime entries.

One of the primary reasons why naked trading is so attractive to forex traders is because naked trading allows for early entries into trades. Indicators may alert traders to the fact that the market has turned around after the market has turned around, but naked traders may find turning points in the market as they occur. Naked trading strategies are based on the current price of the market, and, therefore, they allow for an earlier entry. Indicator-based trade signals will lag because it takes timefor the price data to be processed through the formulas that make up the indicator.

Significant moves in the forex market occur before a technical indicator provides a signal I C A T O

Naked traders have an incredible advantage. Entering a trade early often means the entry price is closer to the stop loss price. A tighter stop loss may mean more profits, the precise reason for this is examined later in the article. After mastering a few simple strategies, naked traders find it very difficult to move back to indicator-based strategies simply because naked trading strategies remove the lag time that is inherent with indicator-based trading.

TAKING RESPONSIBILITY FOR LOSING TRADES.

All traders experience drawdowns. All traders experience losing trades. However, naked traders take responsibility for losing trades. Indicator based traders often blame their indicators for unsuccessful trades (e.g., “the MACD looked like it was going to cross here,” “my indicator did not load correctly,” “maybe I should change the settings on my indicator because the market has been choppy lately,” “that moving average crossover was a fake out—whipsawed on that one,” etc.), but the naked trader does not have this excuse. There is no scapegoat when you are using market data (price action) to take trades. Trading with price action, that is, the actual price on the chart as the basis for all trading decisions, means that the naked trader has no excuse for losing trades. This is extremely liberating for many traders. The indicator-based trader also has the added advantage of an indicator to blame when things go awry; the naked trader can blame no one but the market for losing trades. This is a subtle but very important difference point of reference for the naked trader. All trading involves an aspect of luck. All traders experience a lucky streak of winning trades and an unlucky streak of losing trades. Without the crutch of indicators, naked traders are more likely to take responsibility for their trading results.

To find out more Forex Trading in Nigeria Without Indicator,with us today visit www.onlineforexafrica.com, or call: +2348145386347 Or mail us at [email protected]

Instaforex-Africa is an online forex broker agency that will provide you the technical know hows on how you will succeed in your quest to become successful with your online forex trading. We provide the forex trading platforms and free forex trading tutorials. Call us today on 08133450038 and get our professional agent guide you through the process of setting up a demo account.

INSTAFOREX FOREX TRADING REVIEW

Nigeria e-Naira wallet Explanation

How To Fund Forex Account in Nigeria

Profitable Forex Trading System That Works

Successful Forex Traders Strategies

Forex Trading Strategies For Beginners

No Deposit Forex Bonus Best Forex Bonus